Every business owner understands there are costs involved with doing business including hiring, payroll, rentals, and leases. Few of these costs remain fixed and throughout the day, week, month and quarter, things pop up that can put a stall on business.

This includes hiring. Typically, the need to hire is a good thing. This signals business is doing well and there’s more work than current resources can handle. Knowing the importance of a quick hire, many businesses place current work on hold to review applications and conduct interviews. Depending on the role and the quality of the applicant pool, this can become a time-consuming and costly process.

Therefore, more and more companies are engaging with a staffing agency for assistance. Clients working with a staffing agency share what they are looking for in a new hire along with the culture and environment of the company. Sometimes in the process, the question of the cost of a permanent employee versus a temporary employee is discussed.

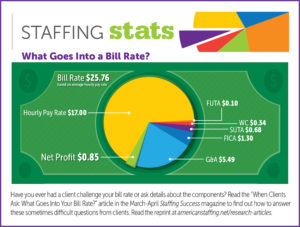

Bill Rate Costs

We are here to explain. There are direct and mandatory employer costs built into any staffing agency’s bill rates. What many potential clients do not realize is these are the same costs paid for any employee working for a company. Let’s take a closer look at the costs involved.

Employee Hourly Pay Rate – Based on what competitive employers are paying for similar skills in FT and temporary positions, higher skills and more experience necessitate higher pay rates.

FUTA – Federal Unemployment Tax Act provides for payments of unemployment compensation to workers who have lost jobs.

WC – Workers Compensation covers workplace injuries or injuries acquired through an occupational hazard.

SUTA – State Unemployment Tax Act established to provide unemployment benefits to displaced workers. This is paid into the state.

FICA – Federal tax paid by employees and employers for Social Security (6.2% of wages up to $137,700) and Medicare benefits (1.45% of all wages).

G&A – General and administrative expenses, including salaries, advertising, marketing, rent, insurance, utilities, repairs, office supplies, dues, postage, government fees, legal expenses.

Misc. – Other expenses can include benefits for local and state paid time off, mandated healthcare and business and occupation (gross receipts) tax. While most businesses do not see these costs broken down for their full-time employees, they are the same whether providing for a temporary or full-time employee.

By working with the employment recruiters at Staffing Kansas City, companies can focus on the day to day business operations and leave the time-consuming hiring process to the SKC experts who understand your needs and provide “Personnel Services with a Personal Touch”.